Net-zero emissions have become an international trend, the first wave of targeted companies includes 281 high-emission enterprises with annual emissions exceeding 25,000 metric tons. With the introduction of “carbon fees,” businesses will face stricter carbon emission regulations and potentially high carbon cost pressures.

How should companies prepare in advance to avoid high costs and comply with future regulatory requirements? As global climate action and domestic and international “carbon policies” continue to advance, proactive preparation is essential.

Taiwan’s carbon fee will take effect on January 1, 2025. A trial declaration will take place in May 2025 without fee payments, but by May 2026, fees will start to be collected, targeting the first wave of applicable companies.

Companies that propose “self-reduction plans” can apply for preferential rates.

Taiwan and international standards and tools for carbon inventory are available. If you are interested in discussing or replacing polishing processes or materials in your current operations after reading this article, feel free to reach out.

What is Carbon Footprint Verification?

Carbon footprint verification is a method used to quantify and track greenhouse gas emissions generated by businesses, organizations, or individuals. The goal of this process is to understand the emissions of carbon dioxide and other greenhouse gases, such as methane and nitrous oxide, from specific activities, products, or operations over a certain period. The results of a carbon inventory are typically expressed in terms of “carbon dioxide equivalent” (CO₂e), which converts various greenhouse gases into a single metric for easier comparison and management.

(Further reading:What is Carbon Footprint Assessment?Understanding the 5 Steps for Carbon Assessment to Grasp theFuture of Carbon Reduction)

International standards for carbon footprint verification

To reduce barriers in managing carbon emissions across international trade, companies typically adopt unified international standards for carbon inventory.

These standards help quantify greenhouse gas emissions and prepare corporate carbon inventory reports. Currently, the International Organization for Standardization (ISO) provides several key standards, including:

ISO 50001 (Energy Management Systems):

Designed to helpcompanies systematically manage energy use and reduce energyconsumption and carbon emissions.

ISO 14064-1 (Organization-level Carbon Inventory): Provides specific guidelines for businesses, organizations, or other institutions to conduct, report, and verify greenhouse gas emissions inventories.

ISO 14067 (Product-level Carbon Inventory): Focuses on calculating and reporting the carbon footprint of products throughout their entire lifecycle, ensuring compliance with low-carbon requirements.

What types of businesses need to actively conduct carbon inventory? Which businesses can proceed gradually?

Businesses that need to actively conduct carbon footprint verification

1.Enterprises under pressure from international supply chains:

Many well-known multinational corporations have incorporated carbon neutrality and net-zero emissions into their core strategies, requiring suppliers to provide detailed carbon emission data and reduction plans.

Taiwanese companies play a significant role in international supply chains, with many acting as suppliers to global brands.

Businesses within these supply chains must respond quickly by conducting carbon inventory, adopting renewable energy, improving energy efficiency, and reducing waste to lower their carbon footprint. These measures not only meet customer demands but also enhance competitiveness in the global market.

2. Enterprises affected by the “carbon tariff” system:

In response to policies such as the European Union’s Carbon Border Adjustment Mechanism (CBAM) implemented in 2023 and the Clean Competition Act (CCA) proposed by the U.S. Senate in June 2022, carbon taxes are imposed on high-carbon products. These taxes primarily target industries with high emissions, such as steel, cement, aluminum, chemicals, and fertilizers, especially those exporting products to the EU and U.S.

These policies require companies to report carbon emissions and pay additional taxes for their products, significantly impacting carbon-intensive industries.

Due to the EU’s stringent climate policies, the CBAM aims to reduce the risk of carbon leakage by encouraging producers outside the EU to reduce emissions. This initiative also pushes other nations to accelerate the formulation of relevant regulations and mechanisms to align with global decarbonization trends.

Reference Station: EU Member States (as of February 2020): Germany, France, Italy, Netherlands, Belgium, Luxembourg, Ireland, Denmark, Greece, Spain, Portugal, Austria, Finland, Sweden, Poland, Hungary, Czech Republic, Slovakia, Estonia, Latvia, Lithuania, Slovenia, Cyprus, Malta, Bulgaria, Romania, and Croatia—27 member countries in total.

3. Required by the ministry of environment:

Greenhouse gases verification provides a clear picture of emissions, thereby identifying areas and opportunities for reduction and formulating greenhouse gas reduction strategies.

Based on the “Climate Change Response Act”, the ministry of environment announced the “Regulations for Inventory, Registration, and Verification of Greenhouse Gas Emissions from Enterprises” to mandate specific industries to conduct carbon inventory. Targeted industries include power generation, steelmaking, petroleum refining, cement manufacturing, semiconductor production, and thin-film transistor liquid crystal display manufacturing.

First wave (since 2016): Businesses with annual direct greenhouse gas emissions exceeding 25,000 metric tons per site are required to conduct carbon inventory.

Second wave (effective January 1, 2023): Businesses with annual greenhouse gas emissions exceeding 25,000 metric tons from the combination of direct emissions from on-site fuel combustion and indirect emissions from electricity use are required to conduct carbon inventory.

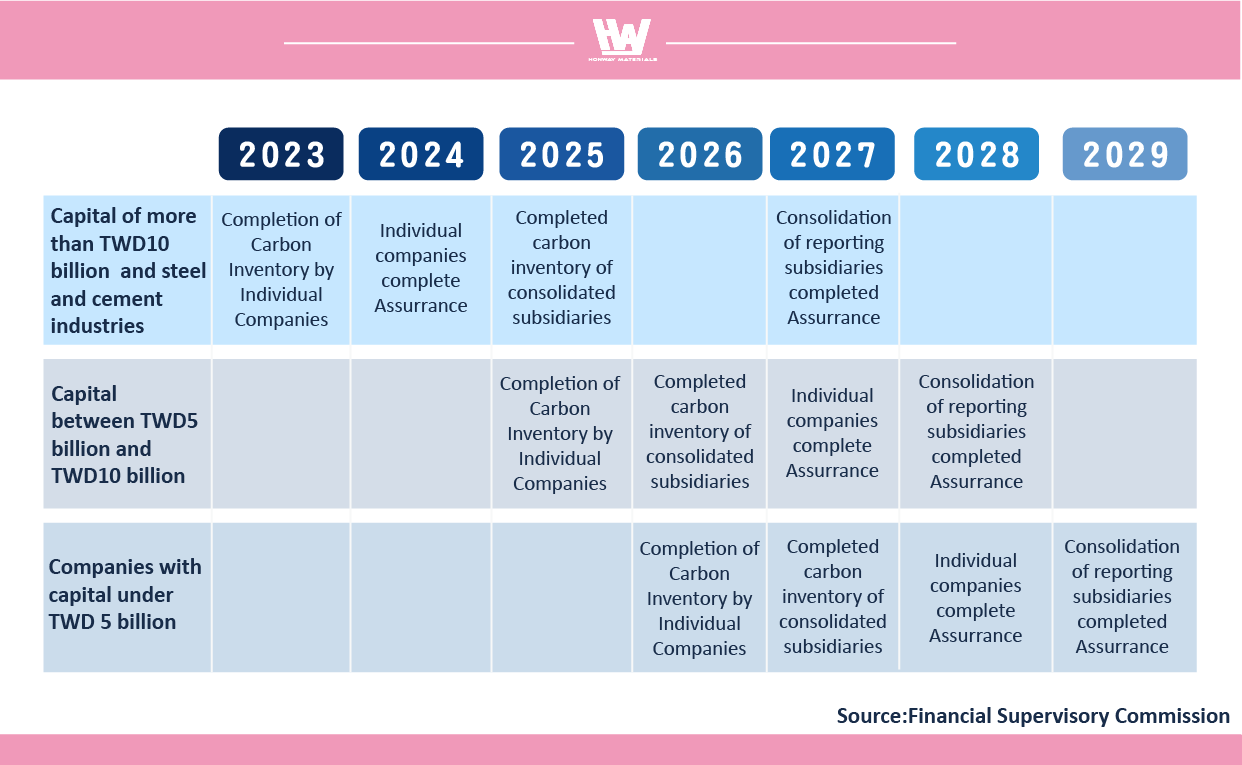

4.Due to the restriction of Financial Supervisory Commission(FSC)

In March 2022, Taiwan’s Financial Supervisory Commission (FSC)officially launched the “Sustainability Development Roadmap for Listed Companies.”

Phased verification plan

Phase 1 (From now until 2024)

Individual listed companies with capital exceeding NT$10 billion, as well as entities in the steel and cement industries, are required to conduct carbon footprint verification.

Phase 2 (2024-2025)

Listed companies with capital over NT$10 billion and consolidated subsidiaries of steel and cement industries must complete carbon footprint verification.

Listed companies with capital between NT$5 billion and NT$10 billion are required to perform verification at the individual company level.

Phase 3 (2025-2026)

Listed companies with capital between NT$5 billion and NT$10 billion must also ensure their consolidated subsidiaries complete carbon footprint verification.

Listed companies with capital under NT$5 billion are required to conduct verification at the individual company level.

Phase 4 (from 2027)

Consolidated subsidiaries of listed companies with capital underNT$50 billion are required to complete carbon footprint verification.

Enterprises that can gradually conduct carbon footprint verification:

Small and Medium Enterprises (SMEs):

- With limited resources and not facing immediate regulatory or market pressure

- Starting with simple carbon footprint verification or energy consumption management is recommended to build capabilities gradually.

Low-Carbon Sectors:

- Industries such as service, IT, legal, or educational institutions, which have relatively low carbon emissions and limited emissions sources.

- Focus on reducing electricity usage and improving energy efficiency.

Domestic Market-Focused Companies:

- Enterprises not directly engaged in international trade and whose main clients do not operate in global markets are currently less exposed to carbon tax or international standards pressure.

Emerging or Startup Enterprises:

- Treat carbon audits as a long-term goal while prioritizing business expansion and core operations.

However, regardless of immediate priority, early preparation for climate impact and carbon neutrality trends is a key long-term strategy.

What are the Scopes of Carbon Footprint Verification?

Carbon audits primarily target specific greenhouse gases regulated under the Kyoto Protocol. These gases are identified for calculation and reduction:

- Carbon Dioxide (CO₂)

- Methane (CH₄)

- Nitrous Oxide (N₂O)

- Hydrofluorocarbons (HFCs)

- Perfluorocarbons (PFCs)

- Sulfur Hexafluoride (SF₆)

- Nitrogen Trifluoride (NF₃)

The Global Warming Potential (GWP) varies for each gas. In carbon verification, emissions are standardized as Carbon Dioxide Equivalent (CO₂e) for unified calculation and comparison.

Key Challenges: Apart from CO₂ and naturally occurring gases, methane presents the most significant impact, making it a critical focus area for mitigation efforts.

What Kind of Carbon Footprint Verificaion Systems do Enterprises Need?

Taiwan’s Ministry of Economic Affairs and Ministry of Environment have introduced several digital tools for carbon emission estimation, suitable for enterprises of various scales.

These tools range from simple energy-use data analysis to precise emission calculations. Enterprises can estimate annual carbon emissions by inputting energy consumption data, such as electricity or fuel bills, into the tool’s corresponding fields.

※ Initially, large corporations lead the implementation of carbon verifications. While SMEs are not yet regulated by the Ministry of Environment, no business can remain untouched by the global push towards net-zero emissions.

※ Enterprises pursuing advanced carbon verifications or greenhouse gas verification must follow the Ministry of Environment’s Guidelines for Greenhouse Gas Emission Inventory or comply with relevant ISO standards to ensure data accuracy and regulatory compliance.

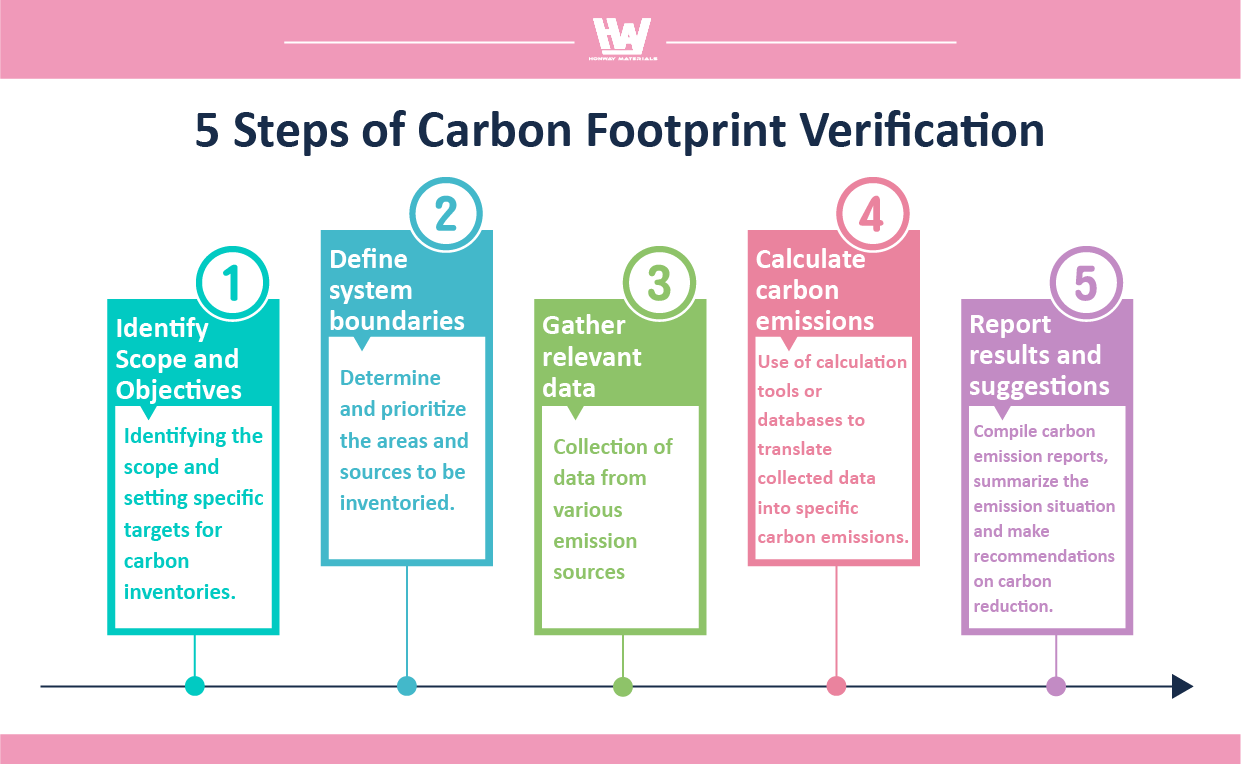

What are the steps of carbon footprint verification?

Taiwan uses CNS-14067 as the standard for conducting carbon footprint assessments. Companies can carry out the assessment process by following these five steps:

- Define Scope and Objectives: Enterprises need to identify the scope of the verification (Scope 1, 2, 3) and establish specific goals.

- Confirm System Boundaries: Determine the sources and boundaries of emissions and prioritize areas for focus.

- Data Collection: Gather data from identified emission sources based on the defined scope.

- Calculate Emissions: Use appropriate tools or databases to convert collected data into measurable carbon emissions.

- Reporting and Recommendations: Prepare a carbon emissions report summarizing findings and proposing actionable strategies for reduction.

(Further reading: What is Carbon Footprint Assessment? Understanding the 5 Steps for Carbon Assessment to Grasp the Future of Carbon Reduction)

The Future Development of Carbon Footprint Verificaion

Carbon footprint verification play a pivotal role in the future of the EU Carbon Border Adjustment Mechanism (CBAM),the Clean Competition Act (CCA), and carbon trading. These footprint verification will deepen their application in global decarbonization efforts and carbon market integration, impacting policy implementation, corporate business models, and international trade regulations.

Enhancing Supply Chain Transparency and Resilience: CBAM and CCA will impose stricter decarbonization requirements across supply chains. Carbon footprint verification help small and medium-sized enterprises (SMEs) integrate into global carbon management frameworks, thereby enhancing overall competitiveness.

Driving Internal Carbon Pricing: Based on carbon footprint verification results, enterprises can establish internal carbon pricing mechanisms. This lays the foundation for participating in carbon market trading, such as selling surplus allowances or purchasing carbon offsets.

Encouraging Low-Carbon Innovation: Carbon footprint verification identify high-emission areas, driving companies to accelerate technological improvements, energy transitions, and the development of low-carbon products. This positions them for greater advantages in the carbon market.

Preventing Carbon Leakage: As carbon footprint verification become more widespread, policymakers can more effectively monitor cross-border emissions, preventing the relocation of high-emission production to regions with looser regulations.

Supporting Regional and International Carbon Market Integration: The standardization of carbon footprint verification will facilitate the linkage of carbon markets across regions, such as the EU and the US, creating a global carbon trading network and reducing transaction barriers.

Redefining Product Competitiveness: Carbon footprint verification will become a prerequisite for exporting products in international markets, particularly in high-carbon sectors regulated by CBAM, such as steel and cement.

Promoting Global Supply Chain Decarbonization: Enterprises insupply chains exporting to European and American markets must conduct carbon footprint verification and demonstrate the low-carbon advantages of their products, thereby advancing the global transition to low-carbon supply chains.

Carbon footprint verification will be central to addressing CBAM,CCA, and carbon trading markets. Their evolution will not only promote policy and market integration but also drive global supply chain decarbonization, industrial transformation, and international collaboration. In the global push for net-zero emissions, carbon footprint verification are not just a compliance tool but also a key driver of green growth and sustainable development.

Conclusion

Key to Navigating Future Challenges and Opportunities

As the world moves towards net-zero emissions, carbon footprint verification have become critical for enterprises to address future challenges and opportunities. From complying with regulations and international market demands to enhancing market competitiveness, carbon footprint verification are reshaping corporate business models, supply chain management, and development strategies.

Basic Requirement for Corporate Development

In the future, carbon footprint verification will become a baseline requirement for corporate growth. Whether to comply with international policies like CBAM and CCA or to participate in carbon trading markets, enterprises will need precise carbon emission data to ensure compliance and cost control. At the same time, growing consumer attention to environmental sustainability means that product carbon footprint transparency will directly impact brand reputation and market competitiveness.

Action

- Learn what ESG is at once>>>What is ESG? What Benefit can ESG Bring to Companies? How to Implement ESG?

- Mandatory Carbon Inventory for Large Enterprises>>>What is Carbon Footprint Verification? Understanding the 5 Steps for Verification to Grasp the Future of Carbon Reduction

- Taiwan policy>>Master Global Issue at Once: Net Zero Emissions and Carbon Neutrality

- Evaluate whether the current manufacturing processes meet carbon reduction objectives.

- Assess if the existing polishing processes could be replaced with more carbon-efficient alternatives.

- How to implement

- Implement testing and review

Source: Climate Change Agency of the Ministry of Environment, Financial Supervisory Commission, Development Agency of the Ministry of Economic Affairs

Honway specializes in physical polishing, ultra-hard abrasives, and rare-earth materials, striving to provide polishing solutions with reduced environmental impact. If you have related needs or would like to learn more, please feel free to contact us! Let’s work together toward a sustainable future.

Customized Grinding Solutions: We offer tailored adjustments to our grinding processes, allowing us to meet specific processing needs for maximum efficiency.

After reading the content, if you still don’t know how to select the most suitable option,

Feel free to contact us and we will have specialist available to answer your questions.

If you need customized quotations, you’re also welcome to contact us.

Customer Service Hours: Monday to Friday 09:00~18:00 (GMT+8)

Phone: +8867 223 1058

If you have a subject that you want to know or a phone call that is not clear, you are welcome to send a private message to Facebook~~

Honway Facebook: https://www.facebook.com/honwaygroup